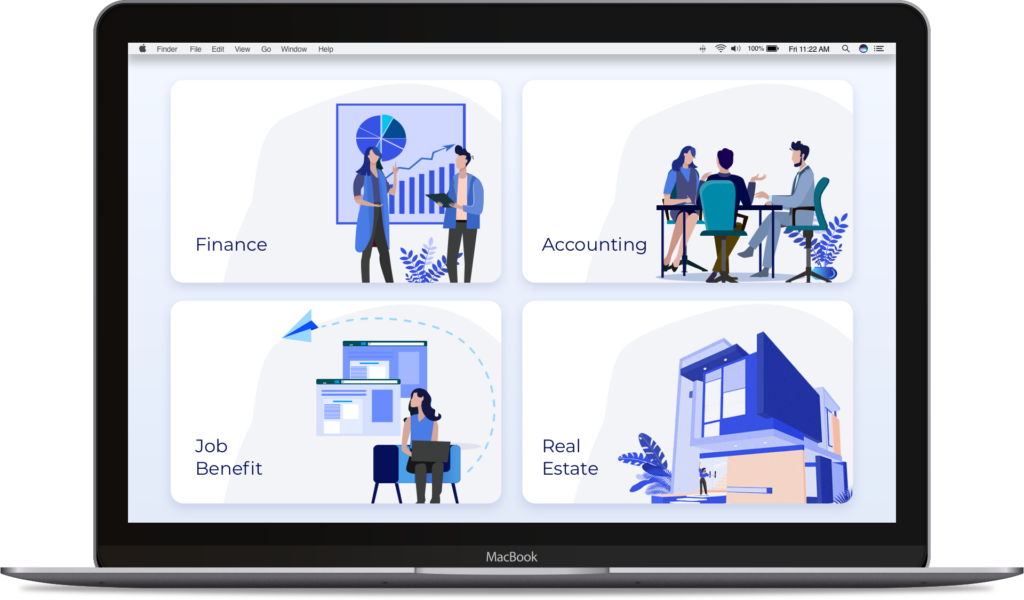

FINANCIAL AUTOMATED APPLICATION (FinApp)

It is for Finance and Administration Solutions to Streamline complex finance and admin processes with automated workflows. With FinApp, you can ensure full legal compliance, audit capabilities, and maximum efficiency of your finance and admin processes by seamlessly integrating your existing systems for financial reporting, contract management, or purchase orders in automated workflows.

Today, most enterprises have already reached a high level of digitalization in their finance and admin departments by using modern digital systems. But are these systems integrated in automated workflows that prevent human errors? Can they ensure consistent reporting and complete recording of all business transactions? Organizations need to be able to meet these complex challenges in their finance and admin departments amid the ever-increasing interactions of global enterprises.

Design and implement automated and integrated solutions for optimum efficiency, reliability, and compliance Consistency, compliance, and transparency are key values in the finance and admin department. In order to meet these requirements, employees must invest a high amount of time and effort – yet it cannot be ensured that human interaction in finance and admin workflows is auditable and reliable.

FinApp allows you to quickly and easily design and implement a customized, end-to-end solution that fully automates your finance and admin processes and seamlessly integrates and connects the systems, data, and people involved. Automated finance and admin solutions built with our cloud-native application platform eliminate erroneous manual tasks, save time and effort for employees, and maximize business efficiency.

Tackle the increasingly complex challenges in finance and admin with fully customized, end-to-end solutions in FinApp

Modules:

• Finance Management • Accounting Management • Job & Benefit Management • Real Estate Management

FinApp’s intuitive user interface enables you to easily create scalable, end-to-end solutions that perfectly fit your needs and significantly improve the performance and transparency of your finance and admin processes.

Guarantee full legal compliance and audit capabilities

Advanced process management and integration capabilities provided by FinApp allow you to quickly deliver thorough automation and seamless recording of your business transactions, ensuring compliant and auditable finance and admin workflows.

Solutions to:

- API Management

- Digital Business Automation

- Enterprise Mobility

- IBM Notes Replacement

- IoT Integration

- Salesforce Integration

- BPM Integration

- SAP Integration

- Workflow Automation

Finance & Financial Management is a vital activity in any organization. It is the process of planning, organizing, controlling and monitoring financial resources with a view to achieve organizational goals and objectives. It is an ideal practice for controlling the financial activities of an organization such as procurement of funds, utilization of funds, accounting, payments, risk assessment and every other thing related to money.

In other terms, Financial Management is the application of general principles of management to the financial possessions of an enterprise. Proper management of an organization’s finance provides quality fuel and regular service to ensure efficient functioning. If finances are not properly dealt with an organization will face barriers that may have severe repercussions on its growth and development.

Significance:

- Being accountable

- Securing future

- Eliminating fraud and theft

- Making productive decisions

- Achieving objectives

- Enhancing credibility

- Strengthening fundraising efforts

Process:

- Assessing the need

- Identifying key roles & responsibilities

- Gathering Information

- Drafting policy

- Consulting with appropriate stakeholders

- Finalizing/Approving policy

- Considering other procedures/measures

- Implementing

- Monitoring & Reviewing

Ask Before you develop:

- Does the organization have a board-approved budget at the beginning of fiscal year?

- Are the financial goals set before the beginning of budget development process?

- Does the budget development process include revenue budget and expenses by program/function?

- Does the budget process include strategy development for funding overhead costs?

- Does the organization have year-end predictions at regular intervals throughout the year?

- Does the organization have a process for evaluating funding avenues before applying?

- At what intervals does the organization produce reports to the management committee?

- Does the organization use dashboards to highlight key indicator performance?

- When does the organization forecast year-end financial result?

- Does the finance staff have proper understanding about job descriptions?

- Does the finance staff receive proper training and guidance?

- Are the finance staff aware about the organizational goals and objectives?

- Does the finance office maintain an annual calendar of important events and activities?

- Does the organization have fiscal workflow processes?

Structure:

All financial decisions, activities and plans are done in accordance to a set of procedures that form the basis of the financial policy. Once the financial objectives are confirmed, the next move is to frame policies to guide its further proceedings. Financial management policy of an NGO is a manual that covers all the accounting policies, procedures and systems of the organization. Primarily, there are two purposes for framing a financial policy

To investigate proper governing of the financial transactions taking place in the concern so that the staff can abide by the set procedures and

To fulfill requirements of local statutory bodies and establish strong management practices, as adopted by the NGO.

Principle of Financial Policy:

- Consistency

- Accountability

- Transparency

- Viability

- Integrity

- Oversight

- Accounting standards

Scope of Policy & Procedures:

Financial management policy throws light on the procedures, systems and accounting policies that are prevalent in the organization. The policy contains information about input, output, processing, control and distribution of financial data.

Purpose of Policy & Procedures:

- To aid in maintenance of controls.

- To serve as a training and monitoring resource.

- To be a reference document to be used by the management, employees, auditors and stakeholders.

- To increase accuracy and completeness of data that is posted from source documents (invoices, journals, cashbooks, payment receipts) to the computerized system.

- To offer accurate and credible reports so that management can exercise effective control over organizational operations.

- To detail-out the administrative and operational procedures for input, output, processing and distribution of information to ensure complete security and privacy of files and documents.

Components:

- Funding Agreement

- Bank Accounts & Transaction

- Cash Handling & Transaction

- Controls to be exercised

- Petty Cash

- Cash book maintenance

- Stock & Inventory Management

Responsibilities:

- Governing Body

- Board of Members

- Financial Manager

- Financial Assistant

- Admin Manager

- Admin/Cash Assistant

- Finance Scorecard

Finance scorecard is directly related to all other business scorecards. Since the purpose of the company is to make money, finance is driven by sales and marketing, service and people metrics.

More than simply having a relationship with all the other business functions, finance has its own issues to track, including cash flow, EBITDA (earnings before interest, tax, depreciation and amortization) and DSO (daily sales outstanding).

Characteristics:

- Business processes

- Learning and growth

- Customer perspectives

- Financial data

- Sales Growth

The parameter which is used to measure the performance of the sales team to increase the revenue over a pre-determined period. Sales growth is an essential parameter for survival and financial growth of the company.

A good sales growth can always be used for the benefits of the employees and company in terms of providing salary raise, acquiring new assets, an expansion of the company or the product line. A negative growth is an undesirable outcome, hinting a wrong strategy or decisions.

To Increase the growth of your sales

- Product Quality

- Service Quality

- Eyes and Ears of the company

- Extra mile

- Reporting & Analytics:

- Income Statement

- Balance Sheet

- Cash Flow Statement

You trust the Financial intuition

Go beyond the basics of financial reporting. With reporting and financial analytics, you get all the business, financial, and workforce information you need in one place.

No need of batch reporting:

- Make more informed decisions without traditional ETL processes.

- Create all reports and analytics using the same real-time transactional data.

- View consolidated financial results anytime with automated eliminations, translations, and retained earnings.

- Access benchmarks on financial metrics and compare your performance against peers.

Explore all dimension:

- Analyze and report on any business dimension across finance, HR, and payroll.

- Pivot across and around dimensions on any report.

- Automatically reflect new dimensions in transaction entry, accounting, and reporting.

- Act directly from a business process with embedded analytics.

Deploy the sensible analytics:

- Produce formatted financial statements and regulatory reports.

- Prepare scorecards with embedded comments and nested reports to communicate results.

- Highlight areas requiring immediate attention with visual indicators.

- Prioritize work and manage exceptions using delivered and custom dashboards.

One security model. Complete data control:

- Combine your finance, HR, and payroll data to make decisions based on a single source of truth.

- Maintain one security model across processes, data, devices, and reports.

- Secure and burst reports by role and organization hierarchies.

Combine data from any source:

- FinApp Analytics combines financial data with non-FinApp operational data to reveal even deeper business insight.

- Understand what’s driving your performance.

- Use analytics to act without changing the way you use FinApp.

- Bring together all the data you need in one place.

- View combined FinApp and non-FinApp data in a familiar reporting and analytics framework.

Benefits:

- Improved debt management

- Trend identification

- Real-time tracking

- Liabilities

- Progress and compliance

Different ways to approach:

- The GAAP (Generally Accepted Accounting Principles)

- The IFRS (International Financial Reporting Standards).

- The GDPR: (The General Data Protection Regulation)

Why is it IMPORTANT:

- Taxes

- For other companies, investors, shareholders, etc.

- For internal decision-making

- For improved internal vision

- For raising capital and performing audits

- Adaptive Insights:

It delivers flexible reporting capabilities to help you gain deeper insights into profitability by product and service, so you can make better and more strategic decisions about service mix, customer wallet share, and business seasonality.

Budgeting, Consolidation, Reporting and Business Analytics

- Planning

- Consolidation

- Discovery

- Reporting

- Integration

- Revenue Management:

The application of disciplined analytics that predict consumer behavior at the micro-market levels and optimize product availability and price to maximize revenue growth.

Concept:

Revenue Management is a concept that not only maxims in high period demand, it helps stimulating demand in low periods while avoiding pricing cannibalism. Revenue Management is long term strategic, takes all revenue with their profitability into consideration, can sell low rates even in high demand period.

Significance:

Revenue management is an extremely important concept within the hospitality industry, because it allows hotel owners to anticipate demand and optimize availability and pricing, in order to achieve the best possible financial results.

Revenue management requires forecasting various elements such as demand, inventory availability, market share, and total market.

Conditions:

- Different customers must be willing to pay different prices for the same service or commodity.

- The business must be some ability to predict the changing levels of demand ahead of time.

- Only a fixed amount of resources is available to be sold at any given time;

- A perishable inventory e.g. after a certain point, the resources can no longer be sold.

Strategy:

Revenue Management is the application of analytics that predicts consumer behavior at the micro-market level to optimize product availability and price to maximize revenue growth. The primary aim of a revenue management strategy is selling the right product to the right customer at the right time for the right price.

- Operational Analysis

- Operational analysis is a method of examining the current performance of an operational (or steady state) investment and measuring that performance against an established set of cost, schedule, and performance parameters.

- Operational analysis is a close cousin of accounting and financial analysis, especially in the modern small business.

- With technology linking many of the operational and financial functions and these underlying systems becoming the primary source of data for operations personnel, it is increasingly important the operational goals and financial tracking and measuring are in alignment.

- Without proper measurement and tracking of leading and lagging indicators, it is difficult to get real-time feedback on operational change effectiveness.

Strong planning and analysis ultimately enable you to tell the story of the business.

Financial Planning and Analysis:

Creating a long-term financial strategy is predicated on delivering the right information to the right stakeholder at the right time.

We take a hands-on approach, establishing an optimal planning process that combines best practices with the necessary forecast tools and methodologies. By creating feedback loops with stakeholders and providing actionable insights into business operations, we enable you to understand what moves the needle and why.

- Expenses:

An expense is simply a cost of a business. Expenses are subtracted from revenues to determine profit on the income statement.

Cost of goods sold (COGS) & Cost of services (COS)

Cost of Goods Sold, (COGS), can also be referred to as cost of sales (COS), cost of revenue, or product cost, depending on if it is a product or service. It includes all the costs directly involved in producing a product or delivering a service. These costs can include labor, material, and shipping. The idea behind COGS is to measure all costs (which are variable) directly associated with making the product or delivering the service.

Operational Expense

Operating expenses are the costs that are required to keep the business going day to day (as opposed to expenses that are directly related to manufacturing a product or delivering a service – those are a different type of expense). Operating expenses are listed on the income statement and, along with other costs, are subtracted from revenue to determine profit.

Operating expenses can also be referred to as SG&A (sales, general and administrative expenses) and are often thought of and referred to as “overhead.” The category includes items such as rent, utilities, telephone, research, and marketing. It also includes management and staff salaries… plus everything else that the accountants have decided does not belong in COGS.

Capital Expenditures

A capital expenditure (CapEx) is the purchase of an item that’s considered a long-term investment, such as computer systems and equipment. Most companies follow the rule that any purchase over a certain dollar amount counts as a capital expenditure, while anything less is an operating expense.

Income Statement:

Income statements show the revenue, expenses, and profits for a specific time period. There are many different names for an income statement, including a profit and loss statement, P&L, statement of earnings, or statement of operations. Sometimes the word consolidated is thrown in front of those phrases, but it’s still just an income statement. The bottom line of the income statement is net profit, also known as net income or net earnings.

Profit

Profit is no more and no less than what shows up on a company’s income statement. Any income statement begins with the sales that the company generated during a given time period, which may be called revenue. The costs and expenses on the income statement are those incurred in generating the sales recorded during that time period. Revenue minus costs and expenses equals profit.

Profit, income, and earnings all mean the same thing. Whereas sales is called the “top line” of an income statement, profit is called the “bottom line” (particularly net profit).

There are subsets of profit that may be listed as you go along, too – gross profit, operating profit, and net profit, for example. Each one is determined by subtracting certain categories of expenses from revenue.

If the income statement you’re looking at is for a nonprofit, “profit” may be called “surplus” or “net revenue.”

Profit increases the equity of a company. By the same token, if a business loses money every month, liabilities will eventually exceed assets, creating negative equity. Then it is a candidate for bankruptcy.

Depreciation

Economic depreciation implies that an asset loses its value over time. But accounting depreciation has more to do with cost allocation than with loss of value. When equipment is purchased, there is a time period in which it will be used. Accountants use depreciation to ensure that the costs of revenue are matched to the revenue those costs helped to bring in for each time period.

In effect, we are allocating the cost of the equipment to the periods in which we used the equipment, even though we may have already paid for the equipment long ago. Accountants do this by figuring out how long the asset is likely to be in use, taking the appropriate fraction of its total cost, and counting that amount as an expense on the income statement. Most capital expenditures are depreciated (land is an example of one that isn’t).

Depreciation is typically found in the operating expenses portion of an income statement. However, unlike many operating expenses, depreciation is a non-cash expense in that money does not change hands when this expense is incurred: the cash has probably already been paid when the equipment was purchased.

Balance Sheet

The balance sheet reflects the assets, liabilities, and owners’ equity at a point in time. In other words, it shows, on a specific day, what the company owns (assets), what it owes (liabilities), and how much its worth (equity) is. The balance sheet is called such because it balances, assets must always equal liabilities plus owners’ equity. A financially savvy manager knows that all the financial statements ultimately flow to the balance sheet.

Assets = Liabilities + Owners’ Equity

- Inventory

Inventory is the summation of the value of all raw materials that will be used to make products (raw materials inventory); the value of all the partially assembled product and the labor to assemble it as of the date on the balance sheet (work-in-process inventory or WIP); and the value of all products including the labor to assemble the product that are ready to be sold (finished goods inventory). These are all added together under Inventory in the current assets section on the balance sheet.

Advantages:

- Allows you to leverage inventory

- Allows your business to accumulate inventory (i.e. to meet contractual obligations)

- Easier to get than conventional financing

- Line can increase as your company grows

Importance:

Inventory is a key component of calculating cost of goods sold (COGS) and is a key driver of profit, total assets, and tax liability. Many financial ratios, such as inventory turnover, incorporate inventory values to measure certain aspects of the health of a business.

For these reasons, and because changes in commodity and other materials prices affect the value of a company’s inventory, it is important to understand how a company accounts for its inventory. Common inventory accounting methods include first in, first out (FIFO), last in, first out (LIFO), and lower of cost or market (LCM). Some industries, such as the retail industry, tailor these methods to fit their specific circumstances. Public companies must disclose their inventory accounting methods in the notes accompanying their financial statements.

- Procurement

- Setting a speeding limit

- Aims to save money when and where possible through both cost savings and cost avoidance measures.

- Using an automated procure-to-pay, or P2P system to connect procurement to back office functions, from purchase requisition all the way through invoice processing helps to improve efficiency and mitigate risk.

- Finance Management can pay for everything procurement orders and receives, and procurement is able to use three-way matching to ensure the items they order are what they receive, and what they receive is what they pay for.

- Finance Management provides spend management reports, revenue reports, and other critical data that demonstrates overall company health. Procurement should use these reports to facilitate day-to-day decision-making processes, along with budgeting and financial planning.

Make Sure Procurement and Finance work together:

- Procurement Should Demonstrate Return

- Establish Clear Responsibility Parameters

- Consider Each Department’s Point of View

- Discuss and Agree on Cost Savings Reporting Standards

- Set Financial Goals Together

- Develop a Balanced Inventory Approach

- Discuss Cash Flow Strategies Together

Aid managerial planning and commercial decision-making tasks by providing appropriate financial information and undertaking related accounts administration. Good maths and computer skills are required for a career.

- The process of creating organization goals by identifying, measuring, analyzing, interpreting and communicating information to managers.

- Aim at informing management about operational business metrics.

- Information relating to costs of products or services purchased by the company.

- Budgets are often used to quantify the decisions made in operational planning

- Internal processing used to account for business transactions.

Functions of the Accounting Management

- Assisting FORECAST THE FUTURE

- Assisting IN MAKE-OR-BUY DECISIONS

- FORECASTING CASH FLOWS

- HELPING UNDERSTAND PERFORMANCE VARIANCES

- ANALYZING THE RATE OF RETURN

Roles:

- make decisions.

- Process of identifying, analyzing, interpreting and communicating information to managers to help achieve business goals.

- Data collected encompasses all fields of accounting that informs the management of business operations relating to the costs of products or services purchased by the company

- Performance reports are used to note the deviation of actual results compared what was budgeted.

Financial Accounting:

It keeps track of a company’s financial transactions. Using standardized guidelines, the transactions are recorded, summarized, and presented in a financial report or financial statement such as an income statement or a balance sheet.

Financial Statements:

- Income Statement

- Statement of Comprehensive Income

- Balance Sheet

- Statement of Cash Flows

- Statement of Stockholders’ Equity

- Payroll, Taxes

It’s a fact of business—if a company has employees, it must account for payroll and fringe benefits.

In this explanation of payroll accounting we will discuss the following payroll-related items:

- Gross salaries, wages, bonuses, commissions, and overtime pay

- Payroll taxes withheld from employees’ gross pay

- Payroll taxes that are not withheld from employees and are an expense of the employer

- Employer-paid time off for holidays, vacations, and sick days

- Other employer expenses including worker compensation insurance, medical insurance, and others

- Sample journal entries will be shown for several pay periods for hourly-paid employees and for salaried employees.

- Employees & Non-Employees

- Salaries & Wages

- Minimum Wage & Overtime Pay

- Overtime Premium

- Calculating Overtime Pay for a Salaried Person

Payroll Withholdings: Taxes & Benefits Paid by Employees

- Employee portion of Social Security tax

- Employee portion of Medicare tax

- Federal income tax

- State income tax

- Court-ordered withholdings

- Other withholdings

- Net Pay

Payroll Taxes, Costs, and Benefits Paid by Employers

- Employer portion of Social Security tax

- Employer portion of Medicare tax

- State unemployment tax

- Federal unemployment tax

- Worker compensation insurance

- Employer portion of insurance (health, dental, vision, life, disability)

- Employer paid holidays, vacations, and sick days

- Employer contributions toward 401(k), savings plans, and profit-sharing plans

- Employer contributions to pension plans

- Post-retirement health insurance

Depositing Federal Payroll Taxes

The employer is required to deposit the federal payroll taxes (amounts withheld from employees and the employer’s matching amount) to the U.S. Treasury by means of an electronic funds transfer (EFT). Generally, this is done using EFTPS which is a free service of the U.S. Treasury.

Outsourcing Payroll Processing

Many companies choose to outsource the processing of payroll to large payroll processing firms (ADP, Paychex, and others), banks, accounting firms, etc.

The services of payroll processors can vary and the company using the service may be able to select the features it will use. Some of the common features include:

- Preparing the employee paychecks or processing direct deposits based on data (hours worked, etc.) furnished by the company

- Preparing the payroll summaries (by department, total company)

- Preparing and filing tax reports

- Preparing IRS Form W-2 for each employee and transmitting them to government agencies

- Remitting payroll taxes to government agencies

We know how complex and time-consuming employment and benefit management can be. You want to offer the strongest benefit package possible for your employees, but the plan also needs to be right for your business objectives. Achieving those two goals can be a challenge.

That’s where our group benefits consultants come in. When you work with the experienced and knowledgeable group benefits consultants at Lang Financial, you’ll get a long-term employment and benefits management partner. We work with you to make sure your plan is the right one for your employees and your business.

Integrate benefits into your system. Employees can evaluate, compare, and choose the right benefits selections online or from a web & mobile device in minutes.

Complete coverage tailored to your needs.

From healthcare to retirement and everything in between, our all-in-one platform keeps employees covered so you can work with confidence.

- Medical

- Dental

Bring your own plans and broker, or work with one of our broker partners to offer quality health coverage.

Choosing the Right Benefits Broker.

Find the best plans for your people, wherever your business is located.

How benefits & brokers work together.

The world of benefits, plans, and carriers can be daunting. Businesses partner with a benefits broker to find plans they might not be able to access on their own.

Two options that fit your business

Access the market’s best plans at competitive prices through one of our certified broker partners or a broker you already know.

Use your own broker

Want to keep your existing broker? No problem. This platform allows you to continue working with your broker and integrate their plans onto our platform.

Use one of our Certified Brokers

With thousands of brokers to choose from, we’ve done the hard work to find you the best ones. The certified brokers we recommend come from the nation’s top firms and are already experienced with the this platform.

Other Benefits

- Commuter benefits

- Life & disability

- 401k

- FSA and HSA accounts

- Supplemental benefits

How it works…

A simple process to provide the benefits you want.

- Select Benefits

Whether you already have a benefits plan or need to find one through a broker, we provide the flexibility and guidance to help you put the right plan in place.

- Open Enrollments

Existing employees and new hires can enroll directly from our platform. You get more predictability and your employees are more educated about their options.

- Use It

The Web & mobile app gives on-the-go access to balances, plans, and claims. Employees can also connect their benefits to other web & mobile apps.

How we’re different…

- No More Paperwork

Our easy-to-use digital benefits platform means the end of manual entry, paperwork, copiers, and faxes.

- Truly Integrated

Our whole platform is natively built, so any changes are automatically synced with the rest of the system.

- Mobile Accessibility

Our mobile app allows employees to enroll and access their benefits wherever and whenever, no phone calls or emails required.

- Exceptional Employee Experience

Simplicity for employees means less confusion, better engagement and increased productivity.

ACA compliance

Benefits compliance can be tricky. Fortunately, our platform does most of the heavy lifting for you.

Automated Compliance

Sleep a little better knowing that this app automates many of your compliance tasks.

Payroll Compliance

Paying your people is the one thing you can’t afford to do wrong. We’ll help you save time and prevent mistakes.

- Automatically calculate taxes, with the option to file and pay them, too

- Create, file, and format W-2s and 1099s

- Provide pay stubs that comply with requirements of most states

- Provide support for FLSA overtime pay regulations for relevant employees

- Easily report new hires to the appropriate state agencies

HR Compliance

Stay confidently compliant with minimal effort when your software handles the heavy lifting for you.

- Onboarding

This application collects new employee tax information, confirms eligibility, and sends required notices.

- Offboarding

This application automatically sends mandatory notices and calculates proper COBRA payments.

- Time Tracking

This application has built-in overtime safeguards and will send employees reminders to take required breaks and lunches.

- Documentation

Keep all required employee documents in one secure place on this application.

- Equal Opportunity Employment Policies

- ERISA

- W-4 and I-9

Benefits ACA Compliance

The Affordable Care Act is over 20,000 pages long. We’ll keep you compliant without showing you a single word.

- Generate, review, and provide 1095-C forms to your employees electronically

- E-file your required 1094-C and 1095-C forms with the IRS

- Monitor your employees’ ACA status

- Receive helpful guidance, customized to your business type.

INCLUDED IN ALL OUR PLANS

Compliance Assistant

Our Compliance Assistant is a resource tool that helps our customers stay on top of federal compliance deadlines for HR, Benefits, and Payroll.

- Detailed explanations help you learn more about the critical compliance deadlines affecting your business

- Set custom deadline reminders, unique to your business

- Sync reminders to your personal calendar so you never miss another deadline

- Use the Compliance Assistant dashboard to monitor your compliance status

Lending against the cash flow generated by a property is the most traditional form of real estate finance. In its simplest form, it involves a loan to a borrower which is repaid from the rental income of the borrower’s property. It is the most used structure for investing in real estate.

Real estate finance transactions are usually classified as either investment or development transactions. The Loan Market Association has published standard form facility agreements for both investment and development real estate finance transactions:

- An investment facility agreement—whereby a loan facility is provided to a borrower for it to purchase a property (or a group of properties)

- A development facility agreement—whereby a loan facility is provided to a borrower for it to purchase a property (or group of properties) as well as providing funds for the development of the property (or properties)

Real estate finance transactions could involve finance for:

- Commercial real estate such as offices, shops, industrial buildings etc—to be repaid from the rent received from tenants (known as commercial real estate finance), or

- Blocks of residential real estate—to be repaid from the sale of individual residential units (known as residential real estate finance)

Key parties in real estate finance

The key parties involved in a real estate finance transaction depend on the type of transaction.

Due to the high value of the asset being acquired, there is often a syndicate of lenders involved in lending money to the borrower to mitigate the risk of each lender and to enable the borrower to borrow larger amounts and to obtain the best funding rates possible.

Investment real estate finance transactions

In an investment real estate finance transaction, the key parties (in addition to the lender(s) and the borrower) will usually be:

- a valuer

- a managing agent, and

- the tenants

Development real estate finance transactions

In a development real estate finance transaction, the key parties (in addition to the lender(s) and the borrower) will usually be:

- The consultants with design responsibility for the development taking place, for example architects, mechanical and electrical engineers, quantity surveyors and structural engineers

- The contractors who are appointed to carry out the development of the property—builders, electricians, plumbers etc.

- A managing agent (as in investment facilities)—the borrower will usually appoint a managing agent to run the property once the development has been completed, and

- The tenants of a commercial property or the purchasers of residential units

Amortization

Amortization is the process of spreading out a loan (such as a home loan or auto loans) into a series of fixed payments. While each monthly payment remains the same, the payment is made up of parts that change over time. A portion of each payment goes towards interest costs (what your lender gets paid for the loan) and reducing your loan balance (also known as paying off the loan principal). Your last loan payment will pay off the final amount remaining on your debt.

Amortization Table

An amortization table is a schedule that lists each monthly payment in a loan as well as how much of each payment goes to interest and how much to the principal.

- Scheduled payments

- Principal repayment

- Interest expenses

Adjustable-Rate Mortgage (ARM)

An adjustable-rate mortgage (ARM) is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. With an adjustable-rate mortgage, the initial interest rate is fixed for a period. After this initial period, the interest rate resets periodically, at yearly or even monthly intervals. ARMs are also called variable-rate mortgages or floating mortgages. The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

Key Points:

- An adjustable-rate mortgage (ARM) is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan.

- With adjustable-rate mortgage caps, there are limits set on how much the interest rates and/or payments can rise per year or over the lifetime of the loan.

- An ARM can be a smart financial choice for home buyers that are planning to pay off the loan in full within a specific amount of time or those who will not be financially hurt when the rate adjusts.

ESCROW

Escrow is the process by which a neutral third party mediates a real estate deal, holding money and property “in escrow” until the two sides agree that all the conditions are met for a sale to close. By contrast, an escrow account is usually an account that helps to manage a mortgage borrower’s annual tax and insurance costs.

Escrow refers to a third-party service that’s usually mandatory in a home purchase. When a buyer and seller initially arrive at a purchase agreement, they select a neutral third party to act as the escrow agent. The escrow agent collects what is known as “earnest money” from the buyer: a deposit that is equal to a small percentage of the sale price. In exchange, the seller takes the property off the market. Until the final exchange is completed, both the buyer’s deposit and the seller’s property are said to be in escrow.

How EXCROW works:

When you obtain a mortgage loan from a bank or direct lender, you also receive an escrow account that helps you pay your property taxes and homeowner’s insurance premiums on time. Even though these costs are paid on an annual basis, your lender will require you to pay a monthly fraction towards each cost and accumulate the balance in your escrow account. This ensures that these expenses get paid on time every year.

Escrow offers:

Escrow Offer allows buyers and sellers to negotiate a price for domain names, cars, boats, aircraft, fine art or any high-value item on any website or mobile app through a Make Offer button or API call – protected by the security of escrow payments.

What is Escrow Offer?

Escrow Offer is the easiest way to introduce the power of price negotiation for escrow transactions to your website, online store, mobile app or classifieds site.

- Escrow Offer allows your buyers to submit offers to any item listed on your platform.

- Sellers can review offers, and either accept, reject or counter them.

- Negotiations proceed until a deal is reached and the escrow process begins.

What will my business get from Escrow Offer?

- Improved conversion

Buyers are more likely to engage with sellers if they have a way to negotiate the price of an item.

- Easy integration

Get started in minutes with our API documentation and button creator.

- Manage multiple offers

Sellers can receive and manage multiple offers on the same listed item.

- User friendly workflow

Users can submit, accept, counter or reject offers via the streamlined interfaces on Escrow.com.

- Safe and secure

Establish credibility with your customers, as Escrow Offer is supported by the most trusted, licensed online escrow service in the world.

How do I add Escrow Offer to my website?

You can add the negotiation power of Escrow Offer to your business with a single API call. Or you can simply create a Make Offer Button, and your buyers will be automatically redirected to the Escrow Offer experience.

Fixed-rate mortgage

Financial product that has a constant interest rate for the life of the loan.

Borrowers commonly encounter two types of mortgages: the fixed-rate mortgage and the adjustable-rate mortgage.

The fixed-rate mortgage has a multitude of term options that vary from 10 to 30 years. Regardless of your preferred length, the interest rate remains the same for the length of the mortgage. This makes the fixed-rate mortgage a popular choice for homeowners who prefer a stable, budget-friendly monthly payment.

The interest rate for an adjustable-rate mortgage fluctuates over the course of the loan. An adjustable-rate mortgage, or ARM, ties the interest rate to a margin that includes a stated index, such as the Libor or Treasury bill yield. It includes the index plus a spread. While the index changes, the spread remains the same.

Let’s get you a Better deal on your mortgage

Digital convenience with a human touch

- 100% online application process

- Notifications and alerts sent straight to your inbox

- One convenient hub for all your documents

- Award-winning support when you need it

A mortgage process that moves

- Get a pre-approval letter in as little as 3 minutes

- Lock your rate in as little as 30 minutes

- Close up to 2x times faster than the industry average

It’s our job to save you money

- No commissions, no fees

- Smart tech that finds more eligible discounts

- Lower APRs backed by the Better Price Guarantee*

New to mortgages? We’ll be your guide.

Purchase:

- Budget your finances

Find out how much house you can afford in as little as 3 minutes.

- Find a home

Start looking for your home on your own or with one of our vetted agents who can guide you through the process.

- Get verified

Apply for a verified pre-approval letter, which shows real estate agents that your income, assets and debts are fully underwritten. The application process is fully digitized and takes just minutes.

- Make an offer

Take your verified pre-approval letter to your real estate agent and make an offer with confidence. You’ll be showing sellers that you have Better Mortgage’s seal of approval, making your bid much more competitive.

- Close

Simplify and save on closing when you use the Better extended network. Better Settlement Services and Better Insurance save you time and money so you can focus on moving instead of closing.

Refinance:

- Choose your refinance

Choose from a range of Better refi’s using our refinance calculator

- Lock your rate

With our completely online process, this could take as little as 30 minutes

- Upload your docs

No need to wait for a loan officer to be in the office. Do it on your time.

- Closing & Funding

Only four simple steps and you’re good to go. If you need any help along the way, our team is standing by to take your call.

Features

- Sales Growth

- Reporting & Analytics

- Adaptive Insights

- Revenue Management

- Operational Analysis

- Expenses management

- Strategic Sourcing

- Procurement & Inventory

- Bookkeeping

- Business & Personal Accounting

- Payroll Management

- Tax Management

- Accounting Center

- Benefit Plan Management

- Contribution Plan Management

- Executive Compensation

- Amortization

- Adjustable Rate Mortgage (ARM)

- Escrow

- Fixed Rate Mortgage

- Private Mortgage Insurance

Pricing Table

Primary

-

Price/Per User

Basic $50 USD

Business $20 USD

Enterprise $5 USD - One Module

- No. Of Users: N/A

- Public Cloud: N/A

-

Online Community

- Included Full guidance coursework

Standard

-

Price/Per User

Basic $75 USD

Business $40 USD

Enterprise $10 USD - Two Module

- No. Of Users: Minimum 10, No Maximum

- Public Cloud: Yes

-

Standard (12x5)

Premium (24x7)

Premium Plus (24x7 + more)** - Free Training

Business

-

Price/Per User

Basic $100 USD

Business $80 USD

Enterprise $20 USD - Three Module

-

No. Of Users:

Unlimited - Public Cloud: Yes

-

Standard (12x5)

Premium (24x7)

Premium Plus (24x7 + more)** - Free Training

Enterprise

-

Price/Per User

Contact us

for Quote

- All Module

-

No. Of Users:

Unlimited - Public Cloud: Yes

-

All Same

- Free Training

Pricing is subject to UCRYA’s standard terms and conditions and minimum purchase requirements.

* Basic User: Users have admin access, development capabilities, and normal day-to-day functions.

* Standard User: Users have up to four, 24-hour sessions per month.